It is regarded as one of the most important federal policy mechanisms to support the growth of renewable energy in the United States. The Investment Tax Credit (ITC) was established by the Energy Policy Act of 2005 and has become a critical component of making on-site renewable energy systems economic for building projects.

The ITC is currently a 30 percent federal tax credit claimed against the tax liability of residential (26 U.S.C. Section 25D) and commercial and utility (26 U.S.C. Section 48) investors in renewable energy property.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. The Section 25D residential credit allows the homeowner to apply the credit to their personal income taxes. In such a case, the credit is used when homeowners purchase solar systems outright and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit.

According to the Solar Energy Industries Association (SEIA), a non-profit trade association of the domestic solar market, the residential and commercial ITC has helped the U.S. solar energy industry grow by more than 10,000 percent since it was implemented in 2006, with an average annual growth of 52 percent. The ITC has had a staggering impact on other renewable energy industries as well.

Key Extensions

In 2008, the Emergency Economic Stabilization Act (Public Law No. 110-343) included an eight-year extension of both the residential and commercial ITC, eliminating the monetary cap for residential electric installations and permitted utilities and companies paying the alternative minimum tax (AMT) to qualify for the credit.

In 2015, the Consolidated Appropriations Act (Public Law No. 114-113) included a multi-year extension of the residential and commercial ITC and changed the previous “placed-in-service” standard for qualification for the credit to a “commence construction” standard for projects completed

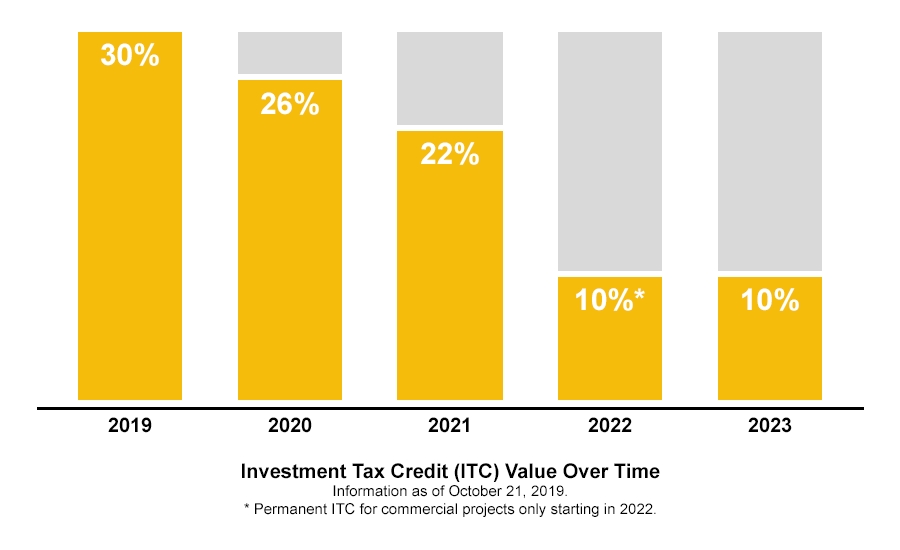

by the end of 2023. It also extended of the 30 percent ITC for both commercial and residential projects through Dec 31, 2019, with a step-down to 26 percent in 2020, and 22 percent in 2021. In 2022 the remaining 10 percent tax credit would remain intact for commercial projects only. At this point in time, the 10% ITC for commercial projects is understood to remain in place indefinitely.

In 2017, the Tax Cuts and Jobs Act (P.L. 115-97) maintained the residential and commercial ITC (by amending the 2015 legislation).

|

Investment Tax Credit (ITC) Value Over Time. |

Beginning of the End of the ITC?

Unless there is action in the next several weeks, it does appear that after December 31, 2019, the ITC will begin a rather severe step-down / phase-out process.

What impact this could have on the domestic renewable energy industries remains to be seen. But speaking from first-hand experience as an architect in Indianapolis, I can attest that the ITC is often necessary to realize a rate of return that is acceptable to clients when it comes to on-site solar energy installations. On a recent project, an analysis of a potential on-site solar energy system yielded the following returns:

- 30 percent ITC (2019 purchase): 18.5 years

- 26 percent ITC(2020 purchase): 19.6 years

- 22 percent ITC (2021 purchase): 21.0 years

- 10 percent ITC (2022 purchase): 24.8 years

At 20 percent, the return is less than 20 years; but without the federal tax credit, the return could be well over 25 years.

Five Percent Safe Harbor

If you have a project considering or intending to purchase an on-site renewable energy system, please consider the "Five Percent Safe Harbor" tax rule.

As stated by IRS Notice 2018-59

"...a taxpayer may establish the beginning of construction by meeting a safe harbor based on having paid or incurred five percent or more of the total cost of the energy property..."

Section 5 of the notice clarifies that "construction of energy property will be considered as having begun if: (1) a taxpayer pays or incurs... five percent or more of the total cost of the energy property, and (2) thereafter, the taxpayer makes continuous efforts to advance towards completion of the energy property..."

This total does not include the price of the land intended to house the energy property.

Don't Miss the Boat on the Safe Harbor!

We are talking about the tax code, so there is a great deal of nuance to this issue. However, any project underway considering renewable energy should be on notice that:

- As of this writing, the ITC is about to step-down on January 1, 2020; and

- There is an opportunity to take advantage of a the Five Percent Safe Harbor tax rules over the next several weeks

The difference between a 30 percent tax credit and even 26 percent over the operational life a renewable energy system could make or break the economic value proposition.

Recent Comments

These are actually very helpful tips. It is...

This is the most beneficial blog for all...

This blog is a great resource for anyone...

Thank you for sharing this important information. I...

This is a very interesting subject of the...