Local utility rebates for enhanced insulation and cool roofing can help solidify decisions to invest in energy-efficient roofing systems.

Learning Objectives

After reading this article, you should be able to:

- Identify ways in which incentive programs for enhanced insulation and cool roofing options help drive energy efficiency in commercial roofing.

- Provide an overview of common incentive programs offered by utility companies for enhanced insulation and cool roofing installations.

- Describe strategies for incorporating incentives and rebates into roofing projects in order to enhance energy efficiency and lower overall costs.

- Discuss common misconceptions about installations eligible for rebates and incentives.

Complete the quiz and receive a certificate of completion!

A variety of factors impact the decision-making process when investing in a new commercial roofing system, including overall building aesthetics, functionality, durability, climate, and of course, costs and efficiencies. When evaluating the latter, the price of the materials themselves is just one component of the calculation. In order to get a true cost analysis, energy costs and potential savings through the use of certain materials must be factored in. It is, therefore, recommended to assess the following when planning the installation of a new roofing system:

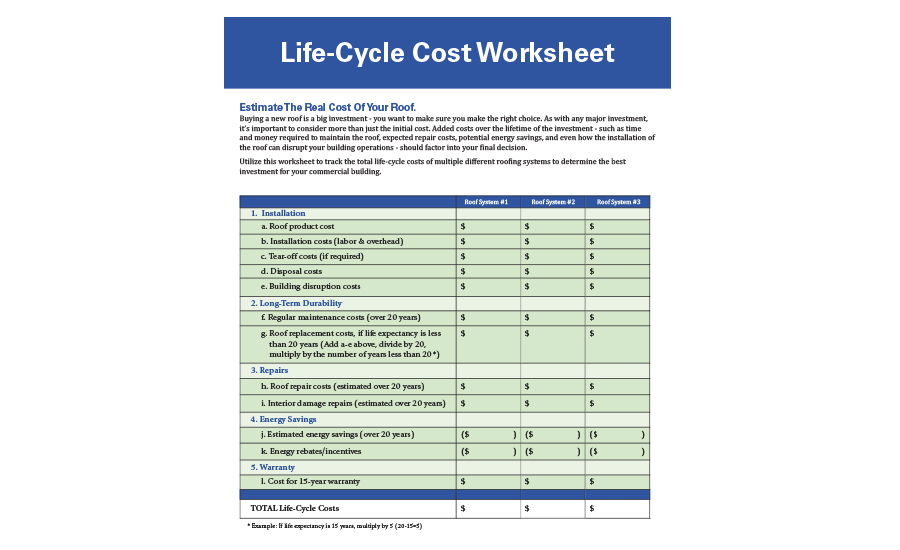

- Entire life-cycle cost of the new roofing system (including tear-off/disposal costs of the old system, material and installation cost of the new system, expected yearly maintenance and upkeep costs for the new system, etc.)

- Available rebates, loans or incentives for reducing energy consumption

- Current monthly energy costs

- Expected monthly energy costs with the new roofing system

Local utility companies and municipalities have offered rebates and incentives to customers for years, encouraging the adoption of energy-efficient practices to relieve the burden on the utility company and environmental resources. The rebate and incentive programs that most people are familiar with include upgrading light bulbs and appliances to newer, energy-efficient models.

However, many utility companies also offer significant rebates and incentives for commercial customers to make upgrades to their buildings through cool roofing and enhanced insulation applications, practices that benefit both the environment and the bottom line. In fact, the 2016 State Energy Efficiency Scorecard report noted that utility spending on electric efficiency programs grew by nearly 300 percent in just nine years, from $1.6 billion in 2006 to $6.3 billion in 2015.1 By researching and incorporating these rebate opportunities into the design and bid process, design professionals can help solidify an end user’s decision to invest in an energy-efficient system like membrane roofs.

Utilize this life-cycle cost worksheet when working with building owners to effectively evaluate the true cost of multiple different roofing systems. Image courtesy of Duro-Last.

As Katie Chapman, sustainability specialist at Duro-Last Inc., explains, “When helping building owners understand the full scope of their roofing investment, it’s important to give them an opportunity to see the big picture beyond the final invoice. By incorporating the complete life-cycle cost of a roofing system, including the annual energy savings and upfront incentive opportunities, they’ll better understand everything that factors into a true return on their investment. The savings afforded by many of these incentive programs may also help fund further energy-efficient upgrades to the building as well.”

This course will examine the ways in which being armed with the appropriate knowledge regarding rebate program qualifications—and then taking the extra step to incorporate rebate figures and potential energy savings from these programs into a project design and bid—can further drive industry trends toward more sustainable practices, products and energy-efficient commercial roofing systems.

What’s Driving Energy-Efficient Industry Trends

Outlined in an article by Richard Fricklas, our understanding of the impact of insulation on energy conservation has evolved as new construction began trending away from higher thermal mass materials like concrete and moved toward lower mass flexible steel materials. By the time of the oil embargo of the early 1970s (and, later, due to natural gas shortages), industry professionals recognized the importance of insulation’s role in regulating a building’s energy consumption and ultimately a building’s impact on environmental resources. As a result, higher insulation standards have been implemented and regulated through regularly updated documents like the American Society of Heating, Refrigeration and Air Conditioning Engineers’ (ASHRAE) Standard 90.1 as well as strict state and national building codes.2

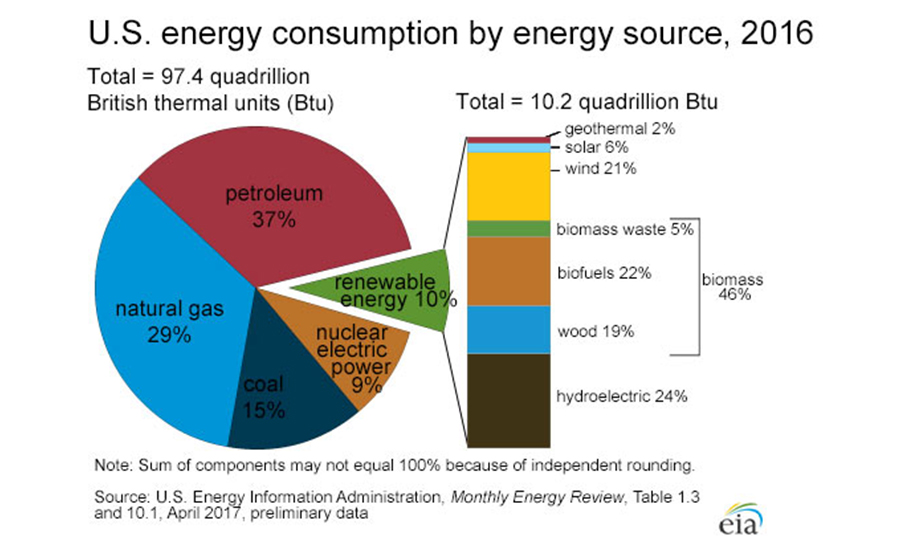

Graph courtesy of the U.S. Energy Information Administration, Monthly Energy Review, Table 1.3 and 10.1, April 2017, preliminary data.

Today, as environmental resources continue to be depleted to meet the growing demands of energy consumption across the country, energy-conscious investments and practices are more important than ever. According to an article published by the U.S. Green Building Council:

“The current worldwide mix of energy resources is weighted heavily toward oil, coal and natural gas. In addition to emitting greenhouse gases, these resources are nonrenewable: their quantities are limited or they cannot be replaced as fast as they are consumed. Though estimates regarding the remaining quantity of these resources vary, it is clear that the current reliance on nonrenewable energy sources is not sustainable and involves increasingly destructive extraction processes, uncertain supplies, escalating market prices and national security vulnerability. Accounting for approximately 40 percent of the total energy used today, buildings are significant contributors to these problems.”3

By enhancing the design and bid process with utility incentives and savings opportunities, industry trends will undoubtedly continue to shift toward the use of materials that reduce the use of non-renewable resources and the strain on overall energy consumption. It’s a simple process that will not only make a lasting impact on the planet for generations to come, but it will improve the trust and relationships with end users as they factor in the positive impact on their bottom line.

Understanding Enhanced Insulation

The importance of insulation is not a new concept—as long as civilizations have been erecting structures, they have been developing methods of protecting them as well. Ancient Egyptians utilized thick stones made of mud to block the desert heat during the daytime and retain heat during the night when temperatures would drop considerably. Ancient Greeks are credited with popularizing asbestos to insulate their homes, while the Vikings used mud to seal the gaps in wooden buildings to protect against the arctic drafts. Today we have much more effective insulation technology at our disposal, but the objective remains the same.

When it comes to rebates and incentives related to enhanced insulation, the common goal boils down to reducing the stress on non-renewable energy resources. By enhancing the R-value on structures, demands on these resource will decrease. However, there are additional benefits to enhanced insulation in commercial structures, including noise reduction and humidity control.

While rebates and incentives vary between utilities, the common themes or structure of these programs across the board include the following:

Rebate amounts are calculated in a “dollars/cents per square-foot” formula. While the amount per squarefoot can differ based on the region and overall energy strain of the utility company’s service area, there appears to be a common “standard range.”

Rebate amounts are typically figured by the amount of added R-value, that is, the greater the increase in R-value, the greater the incentive per square-foot.

Many utility companies require pre-construction application or notification with detailed drawings of current insulation and values as well as proposed insulation additions and values. While some utility companies will work with building owners after a project is underway and/or completed, it’s best to start the application process before work begins in order to confirm eligibility and total rebate amount.

Cool Roofing Utility Incentives

The cool roof concept has been around for quite some time, utilizing a highly reflective surface to direct a significant portion of the sun’s solar heat away from the building. Unlike a dark or non-reflective roof surface that absorbs and transfers solar heat into the building, a light-colored, reflective roof surface drives solar heat away from the building and back into the atmosphere.

Studies conducted by the Departments of Energy in California and Tennessee in the 1980s revealed that energy costs decreased significantly when reflective roof coatings were used, and they reduced overall air temperatures in urban areas.4 More recently, studies cited in the Literature Review of Uncertainty of Analysis Methods (Cool Roofs) indicate that cool roofs can actually reduce the energy used to cool a building by up to 20 percent.5

Today, cool roofing technologies can be found throughout the world, and it’s no surprise that these energy-efficient systems have been contributing significantly to the bottom line of commercial structures. By reducing the demand on electricity consumption when installed over electrically air-conditioned buildings, cool roof systems lower the overall demand on utility companies—especially during peak usage hours. In an effort to encourage the adoption of roofing materials that continue the energy reduction trend, many utility companies offer incentives to offset the initial cost of the investment. Similar to enhanced insulation incentives, the common themes or structure of rebates and incentives for cool roofing systems include the following:

Rebate amounts are calculated in a “dollars/cents per square-foot” formula. While the amount per square-foot can differ based on the region and overall energy strain of the utility company’s service area, there appears to be a common “standard range.”

Rebate amounts are typically figured by the amount of added R-value, that is, the greater the increase in R-value, the greater the incentive per square-foot.

Many utility companies require a pre-construction application/notification with detailed drawings of the current roofing system, as well as proposed roofing system drawings and energy efficiency figures (i.e., reflectivity/absorption). Many companies will require the initial and 3-year reflectivity and absorption values for the proposed roofing system in order to approve a rebate application. While some companies will work with building owners after a project is underway and/or completed, it’s best to start the application process before work begins to confirm eligibility and total rebate amount.

General Utility Rebate Standards

As noted by American Council for an Energy-Efficient Economy (ACEEE):

“States…commonly provide financial incentives through State Energy Offices and Departments of Revenue, which partner with market actors to ensure consumers, retailers, and energy service providers understand the array of financing opportunities available. These incentives are funded through state appropriations, Recovery Act funds, and forgone tax revenue.”6

Perhaps the most important step to take in familiarizing yourself with rebate and incentive programs when choosing efficient roofing materials and systems is to seek the appropriate data for your state or region. While utility companies typically have their own set of standards and application processes, they often share many similarities:

Insulation Rebates

- Eligible for new insulation installed between conditioned and unconditioned spaces.

- Insulation installed above dropped commercial ceilings is usually not eligible.

- Available for existing structures looking to increase current insulation values—typically not offered on new construction projects.

Cool Roof Rebates

- Both new construction and existing buildings are eligible to participate.

- Roof must be installed over an air-conditioned space.

- Minimum solar absorption and/or reflectivity figures must be met.

- Must be an ENERGY STAR or Cool Roof Rating Council labeled product.

Prescriptive vs. Custom Rebates

When researching rebate opportunities through utility companies, the terms “prescriptive” and “custom” can often be found across the board when referring to specific program categories. Since utility companies develop their own programs with their own standards and requirements, there is no universal format for energy-efficient roofing system rebates. However, both prescriptive and custom programs offer a variety of opportunities for building owners to recapture some of their investment.

Prescriptive rebates are more widely used because they are considered straightforward and easy to follow. These rebate programs outline a specific upgrade that can be made, the rebate baseline for making the upgrade and a set of specific standards that must be met. When utilizing a prescriptive rebate, so long as you meet the requirements of the program and properly follow the application and submission process, you’ll be eligible to receive reimbursement for the amount associated with the rebate with little to no hassle.

Custom rebates can be more complicated to implement than prescriptive programs since rebate figures are based on the actual amount of energy being saved with the investment. While many custom programs require more time and effort to have the project approved and energy savings verified through a representative of the utility company, they can offer more flexibility in how the energy savings are achieved.

While prescriptive and custom rebate programs are structured differently, they typically share core commonalities for approval and documentation. Pre-approval is usually required for both types of programs, and always recommended regardless of program requirements, to ensure the availability of funds and qualifications of the project. Additionally, careful documentation of the current state of the roofing system, proposed roofing system upgrades (as well as key energy efficiency values of the new roofing system materials) and overall project scope are needed to successfully apply for either of the programs.

Sample Rebate Programs

Review the samples below (links to PDFs provided in the online version of this course) to gain a general overview of the average prescriptive rebate incentives currently available throughout the United States:

- Average Rebate Programs by Region. Source: Duro-Last

- Duke Energy - Energy Efficiency for Business: Cool Roof. Source: Duke Energy. Republished by permission.

- Long Island PSEG - Cool Roof Program Overview. Source: Long Island PSEG (Public Service Enterprise Group Incorporated]. Republished by permission.

As medical facilities continue to expand to meet growing healthcare needs, so do their overhead costs. Enhanced insulation and reflective roofing investments provide valuable immediate and long-term savings opportunities that protect the bottom line and patient care. Photo courtesy of Duro-Last.

Energy-Efficient Roofing Guidelines and Resources

Sifting through all of the rebate programs and requirements for a given region can be daunting. The resources outlined below have been developed by a variety of different sources and serve as a valuable starting point for incorporating energy rebates into the design and bid process.

U.S. Department of Energy: Cool Roofs: Managed by the U.S. Department of Energy, this website provides updated information about cool roof materials and their benefits, investment considerations, climate and environmental considerations, and information about potential energy savings.

Cool Roof Rating Council (CRRC): The CRRC is a non-profit educational organization that was created in 1998 to “develop accurate and credible methods for evaluating and labeling solar reflectance and thermal emittance (radiative properties) of roofing products. At the core of the CRRC is its Product Rating Program in which roofing manufacturers can label various roof surface products with radiative property values rated under a strict program administered by the CRRC. Code bodies, architects, building owners and specifiers can rely on the rating information provided in the CRRC Rated Products Directory.”

Oak Ridge National Library Cool Roof Calculator (endorsed by the U.S. Department of Energy, ENERGY STAR): The Cool Roof Calculator available via the Oak Ridge National Library website estimates cooling and heating savings for flat roofs with non-black surfaces. This version of the calculator, which was developed by the U.S. Department of Energy’s Oak Ridge National Laboratory (Version 2.0), “is for small and medium-sized facilities that purchase electricity without a demand charge based on peak monthly load.”

ENERGY STAR Roof Products: ENERGY STAR provides a comprehensive and searchable list of ENERGY STAR-certified roof products. The website also includes an easy-to-use “Product Finder” and “Rebate Finder,” which allows users to search for ENERGY STAR partners that sponsor rebates on certified products. To use, you simply enter a zip code to find deals near you.

Database of State Incentives for Renewables and Efficiency: This site, run by The North Carolina Clean Energy Technology Center, is a free and open esource, providing information on thousands of policies and incentives for renewable energy and energy efficiency. It features a searchable map, which allows users to find policies and incentives by state.

Rebates and Incentives Support Emerging Service Trends

While commercial rebate programs offered by utility companies have been available for years, many end users either don’t know about them or are intimidated by the process of applying for them. To combat this obstacle, some building professionals are now offering this as a service and incorporating it into the design and bid process. As this unfolds, more end users will likely see the sustained (and up-front) value of investing in energy-efficient, cool roofing systems. In the long-run, this can make a big impact on driving industry trends toward more sustainable products and practices.

How to Work with the Manufacturer

There may be no better resource for determining what rebate and incentive options are available than the manufacturer of the roofing system you are considering or which has been specified. Manufacturers have the unique ability to be knowledgeable about a wide range of choices—within a region or across the country—that can lend themselves to the goal of energy efficiency and cost savings.

The manufacturer can work with the design team in a number of ways, including:

Inform the architect or design team of local rebate opportunities and assess upcoming projects that may qualify. Larger manufacturers often have the available resources to research and track rebate programs in larger markets and can offer guidance to ensure a specific project meets the qualifications. If you can’t find rebate programs for a specific project while doing research, reach out to the manufacturer as well to see if they have any information they can offer.

Evaluate current available products that meet rebate needs. Manufacturers are required to keep detailed data on all of their products, often employing a centralized document management system behind the scenes. Instead of sifting through all of the data yourself to determine what products would be eligible for a specific rebate program, reach out to the manufacturer to have them gather the information for you. By providing them with the rebate program requirements, they should be able to develop a comprehensive packet of information that outlines each of their qualifying products.

Discuss opportunities for custom products and product combinations to meet rebate needs. Select manufacturers have the ability to create custom products and product-combinations to meet customers’ needs. By providing them with the rebate program requirements and customer needs for the project, these manufacturers can often develop a plan to create customized products, helping ensure that the scope of the project and materials meet the rebate requirements.

Fielding requests to review rebate applications for additional opportunities, correct information and additional resources. Before submitting rebate applications, reach out to the manufacturer for help reviewing the data included on the forms. Many rebate programs require that materials meet specific standards and product data can change as new testing is performed. By partnering with the manufacturer to review the data included in the application, they can serve as a second set of eyes verifying that the information is up-to-date and accurate. They may also see additional opportunities for savings on the application that weren’t considered before.

Beyond the Utility Rebate—Taking Advantage of Federal Tax Incentives and Grants

Incentives offered by utility companies provide unique opportunities for building owners to offset the cost of a new roofing investment; however, alternative opportunities through federal tax incentives and grants can also help drive the energy-efficient trend when rebate programs in a project location are limited.

The tax reform passed by Congress in December 2017 creates an unprecedented opportunity for commercial property owners to upgrade their roofing systems while deducting up to 100 percent of the cost from their taxes immediately. Previously limited to depreciated value deductions over a prolonged period of time, new roof investments have now been included in the tax code Section 179 expansion as a qualified real property deduction.

While it’s important to note that building owners must consult with a tax professional to verify deduction limitations and building qualifications before the roofing project begins, the benefit of utility and tax incentives should be considered during the development of designs and bids.

Furthermore, grants like the Small Business Improvement Fund offered in select districts of the city of Chicago provide small business owners the opportunity to make upgrades to their building that they may not have been able to make otherwise—including roof replacement with energy-efficient materials. These grants cap available funds based on the building’s function, but often provide a simple application process and substantial funds that do not need to be repaid.

Conclusion

Enhanced insulation and cool roofing materials can offer valuable financial incentives to building owners in the short-term through rebates, and in the long-term through increased energy savings. However, the implications of driving energy-efficient trends in the roofing industry reach far beyond the bottom line for end users. By including the use of sustainable, energy-efficient materials in the design and bid process, the demand on non-renewable resources, as well their detrimental environmental impacts, will start to lessen. Taking the initiative to research and include these resources into their services, architects and design professionals have the potential to drive their business, and drive the industry into a new chapter.

References

1. Berg, Weston, Seth Nowak, Meegan Keely, Shruti Vaidyanathan, Mary Shoemaker, Anna Chittum, Marianne DiMascio, and Chetana Kallakuri. The 2016 State Energy Efficiency Scorecard. Report. September 26, 2016. http://aceee.org/research-report/u1606.

2. Fricklas, Richard L. “Roof Insulation and Diminishing Returns.” May 14, 2008. https://www.buildings.com/article-details/articleid/6061/title/roof-insulation-and-diminishing-returns.

3. “Green Building 101: Why Is Energy Efficiency Important?” May 14, 2014. https://www.usgbc.org/articles/green-building-101-why-energy- efficiency-important.

4. “Cool Roofs.” https://www.go-gba.org/resources/green-building- methods/cool-roofs/.

5. Haberl, Jeff S., Ph.D., P.E., and Soolyeon Cho. Literature Review of Uncertainty of Analysis Methods (Cool Roofs). Report. Energy Systems Laboratory, Texas A&M University. October 2004. http://oaktrust.library.tamu.edu/handle/1969.1/2071.

6. “Financial Incentives for Energy Efficiency.” https://aceee.org/topics/financial- incentives-energy-efficiency.

Additional Resources

Duro-Last White Paper: Cool Roofs for a Hot Planet

Duro-Last: California Title 24, Cool Roofs and You

Duro-Last White Paper: Reducing Peak Energy Demand: A Hidden Benefit of Cool Roofs