The fourth quarter of 2008 was a tumultuous time, to say the least. A presidential election was taking place. Commodity prices were volatile. As the economy was in turmoil and bailouts and loans seemed the only ways to salvage the financial and automotive sectors of the economy, Roofing Contractor and Architectural Roofing & Waterproofing magazines turned to contractors to take the pulse of the roofing industry in an exclusive survey sponsored by GAF Materials Corporation.

The publications partnered with Clear Seas Research to conduct a research study to gauge roofing contractors’ sense of the commercial and residential roofing markets. We also wanted to see how contractors expected the market to react over the next 12 months and the next three years.

Specific research objectives of the State of the Industry study included assessing the business conditions in the roofing industry and measuring sales volumes and directions across product categories.

The survey was conducted in October and November of 2008. Clear Seas Research contacted 18,627 contractors for the Web-based survey, and 437 contractors participated for a response rate of 2 percent.

One-fourth of study participants exclusively do residential work, while one-fifth only do commercial work. The remaining 56 percent do both residential and commercial work, the majority of it consisting of replacement or repair. Seventy-six percent of respondents do residential replacement work, 68 percent do residential repairs, 63 percent do commercial replacement, and 62 percent do commercial repairs. On average, 59 percent of their total revenue comes from replacement work, while 21 percent comes from new construction and 19 percent from repairs.

Sales Volume and the Economy

Despite the slumping economy, more roofing contractors indicated total 2008 sales volume increased from the 2007 level than saw it decrease (Figure 1). Forty-five percent had better sales in 2008 than 2007, while 39 percent saw sales to decline. Contractors are increasingly optimistic that sales volume will increase in 2009 and over the next three years (Figures 2 and 3).These relatively optimistic forecasts about their own companies come despite some negative expectations about employment levels and general business conditions.

Roofing contractors indicated that business conditions were generally worse in 2008 than 2007. Further, contractors anticipate business conditions to continue to worsen in 2009, with 43 percent expecting things to be worse this year while 27 percent expect them to be better.

Sales by Product Type

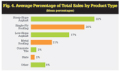

On average, nearly one-third of the roofing contractors’ total sales volume is derived from steep-slope asphalt products (Figure 4). Further, one-fourth of total sales involve single-ply roofing products. Roughly two-thirds of contractors surveyed sell steep-slope asphalt and single-ply roofing products.In 2008, more roofing contractors saw significant increases as opposed to decreases in their single-ply and metal roofing sales. Almost 40 percent of contractors sold more single ply over the past year, while 25 percent sold less. Thirty-five percent of respondents had increased sales from metal roofing, while 20 percent saw a decrease. Dramatic declines were seen in the sales of slate, concrete tile, and low-slope asphalt products in 2008.

More roofing contractors expect to see increases rather than decreases in their 2009 overall sales, with 43 percent expecting an increase, 30 percent expecting a decrease, and 27 percent expecting sales to remain the same (Figure 5). They also expect sales for single-ply roofing, metal roofing and steep-slope asphalt products to increase. Declining sales are expected to continue into 2009 for slate, concrete tile, and low-slope asphalt products.

Roofing contractors tend to purchase their products from only a few manufacturers. Overall, contractors purchased material from an average of seven manufacturers, but when broken down by type of product, the average number of manufacturers used ranges from two to three across all products surveyed.

About the Study

The State of the Industry Study was conducted by Clear Seas Research, a division of BNP Media, which is also the parent company of Architectural Roofing & Waterproofing and Roofing Contractor magazines. For more information about this study or to find out more about Clear Seas Research services, please contact Sarah Turner at turners@clearseasresearch or visit www.clearseasresearch.com.